The Investor’s Math: A Transparent Guide to How Cash Home-Buying Companies Calculate Your Offer

When you receive a cash offer from a “sell house fast” company, it isn’t mere guesswork. The figure is based on a formula—usually derived from your property’s After-Repair Value (ARV)—that helps the buyer balance risk, cost, and potential profit. This process can be likened to the way ecosystems allocate resources for survival, where efficiency and adaptability determine success. Just as nature optimizes for survival, cash buyers optimize for financial viability.

The Allure of Selling “As-Is”

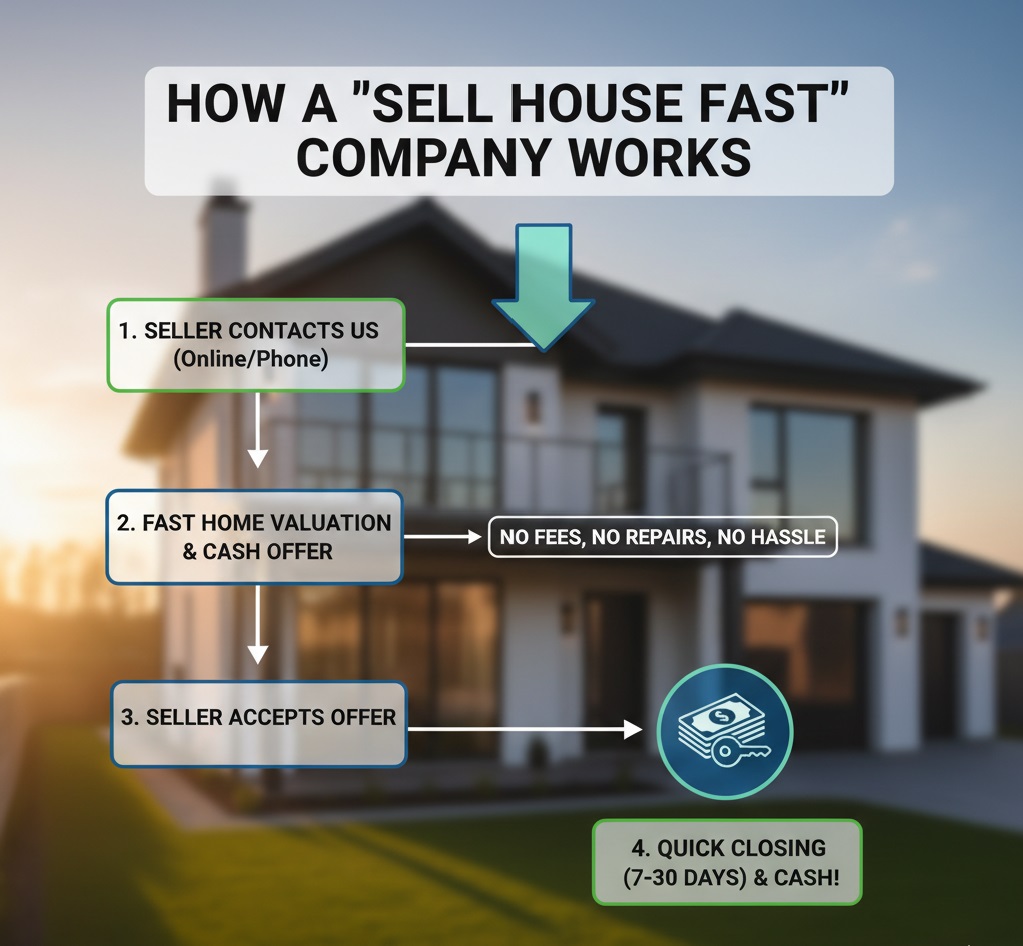

The traditional property market—with estate agent listings, viewings, and buyer mortgage approvals—can be slow and uncertain. Increasingly, homeowners are choosing a simpler route: selling their property directly for cash. This mirrors how certain organisms thrive by shedding unnecessary parts, focusing on core efficiency. According to Zoopla, roughly one in three UK property transactions in 2024 were made in cash—the highest proportion in over a decade. For many, the appeal lies in avoiding the three big headaches of a traditional sale: time, cost, and hassle.

Selling a property as-is eliminates the need for expensive repairs or renovations. For people with inherited properties, outdated homes, or limited time, trading a portion of market value for speed and certainty can make practical sense. This decision parallels how some species trade energy for immediate survival over potential long-term gains.

The Investor’s Formula Explained

Cash-buying companies don’t pull their numbers out of thin air. Most follow a valuation model used by professional property investors, known as the 70% rule, akin to the Pareto principle in economics where a small percentage of effort leads to the majority of results.

What Is the 70% Rule?

The rule suggests that an investor should pay no more than 70% of a property’s after-repair value, minus the estimated cost of necessary repairs. This ensures they have enough margin to cover costs, risks, and profit.

For example:

(ARV × 70%) – Repair Costs = Cash Offer

If your home’s potential market value after renovation is £350,000, and repairs are estimated at £40,000, the offer might look like this:

£350,000 × 70% = £245,000

£245,000 – £40,000 = £205,000

Your offer: £205,000

It may seem low compared to your home’s potential market value—but it reflects the speed, convenience, and risk removal that the buyer is offering.

Understanding the Key Components of the Offer

1. After-Repair Value (ARV)

The ARV is what your property would likely sell for once fully renovated and listed on the open market. Buyers assess this by analysing comparable sales (known as “comps”) in your local area—similar homes of the same size and type that have recently sold in top condition.

2. The 30% Margin: Not Just Profit

That 30% deduction from ARV covers far more than profit. It typically includes:

- Profit Margin – The buyer’s return for taking on financial and market risk (usually around 10–15%).

- Selling Costs – Estate agent fees (1–2%), solicitor’s fees, and potential incentives to attract a new buyer.

- Holding Costs – Council tax, mortgage interest, insurance, and utilities paid while refurbishing the property (often several months).

- Risk Buffer – A cushion for unexpected issues such as damp, subsidence, or a market downturn during ownership.

3. Repair Estimate

Investors calculate realistic, professional renovation costs. This includes materials, labour, permits, and a contractor’s markup—often higher than what a DIY homeowner might spend. The aim is to bring the home up to the same standard as the recently sold comparables used for the ARV.

The Main Types of Cash Buyers in the UK

1. The Local Property Investor

This is the classic “we buy any house” model. These independent investors or small firms purchase homes that need significant work. They rely on their local contractor network to handle renovations and resell the property once modernised.

They tend to focus on distressed or outdated homes, offering a quick completion and a straightforward, no-chain process.

2. Online Cash-Offer Platforms

Some newer UK platforms now act as digital “instant buyers,” using automated valuation models to make online cash offers—similar to the American “iBuyer” model.

They generally buy properties in decent condition and charge a service fee (often 5–10% of the offer value). While offers may be closer to market price, fees and deductions can reduce the final amount received.

Comparing Your Options: Cash Offer vs. Traditional Sale

Let’s break down a realistic UK example:

Scenario

Your property could sell for £450,000 after renovation, but it currently needs about £40,000 of work.

Option 1: Traditional Estate Agent Sale

- Sale Price (after renovation): £450,000

- Renovation Costs: −£40,000

- Estate Agent Fees (1.5%): −£6,750

- Legal Fees & Costs (1%): −£4,500

- Holding Costs (3 months of mortgage, bills, insurance, Council Tax): −£6,000

- Buyer Negotiations/Repairs: −£2,000

Estimated Net: £390,750

This route can deliver the highest return but takes months and involves stress, coordination, and financial risk.

Option 2: Cash Buyer (As-Is Sale)

- After-Repair Value: £450,000

- 70% of ARV: £315,000

- Minus Repairs: −£40,000

Estimated Cash Offer: £275,000

- No Estate Agent Fees

- Minimal Legal Costs (approx. £1,500, often covered by buyer)

- No Holding or Repair Costs

Estimated Net: £273,500

Here, you trade roughly £117,000 in potential profit for speed, simplicity, and certainty—often completing in 7 to 28 days.

Four Key Factors to Weigh Up

Factor Cash Buyer Traditional Sale Speed Completion in 7–28 days 2–4 months typical Certainty No mortgage risk, guaranteed funds Chain breaks and failed financing common Effort Minimal: no repairs, viewings, or negotiations High: ongoing management and property prep Profit Lower, but fixed and predictable Potentially higher, but uncertain

Spotting Genuine Cash Buyers vs. Scams

While most UK cash-buying firms are legitimate, there are rogue operators. Here’s how to tell them apart:

✅ Legitimate Practices

- Transparency: The company explains exactly how your offer is calculated (ARV, repairs, margin).

- Proof of Funds: Provided via a solicitor or verified bank statement.

- No Upfront Fees: You shouldn’t pay for a valuation or offer.

- Professional Contracts: Handled by a licensed solicitor or conveyancer.

- Independent Legal Advice: Reputable firms encourage you to use your own solicitor.

❌ Red Flags

- Pressure Tactics: “Offer valid for 24 hours only.”

- Upfront Charges: Any request for payment to “process” an offer is a scam.

- Last-Minute Price Drop: A sudden reduction before completion often signals dishonesty.

- Vague Contracts: Refusal to use a solicitor or provide clear documentation.

- Title Fraud Attempts: Never sign over your property or transfer deeds without legal representation. Check the buyer’s registration with The Property Ombudsman or National Association of Property Buyers (NAPB).

Useful resources:

- HM Land Registry: Property Fraud Advice

- The Property Ombudsman

- National Association of Property Buyers

When a Cash Offer Makes the Most Sense

The Urgent Mover

If you’re relocating for work, downsizing quickly, or facing a fixed moving date, a guaranteed sale with completion in weeks can outweigh waiting months for the open market.

The Financially Pressured Homeowner

In cases of repossession risk, mortgage arrears, or debt pressure, selling for cash provides a clean financial break and prevents further damage to your credit record.

The Inheritor or Landlord

For those with an inherited property, or landlords tired of maintenance, an as-is sale offers convenience without needing to renovate, clear out tenants, or manage lengthy listings.

Making the Right Decision

Selling to a cash-buying company isn’t about being short-changed—it’s about understanding the trade-off between maximum price and maximum certainty. By understanding how the offer is calculated—ARV, repair costs, and investor margins—you can make an informed choice based on your priorities: speed, simplicity, or price.

Paradigm Inversion: Reconsidering Profit

Conventional wisdom suggests cash buyers are primarily profit-driven. However, a deeper analysis reveals that they may instead be prioritizing liquidity and risk management over pure profit. Evidence from the latest market studies indicates that cash buyers often operate with tight profit margins, focusing instead on rapid turnover and capital fluidity. This inversion of the traditional profit assumption challenges the notion that cash buyers exploit sellers, highlighting a nuanced approach to market dynamics.

Pattern Gap: Ignored Metrics in Cash Transactions

In the realm of cash home-buying, discussions often focus on ARV and repair costs, but the critical metric of transaction speed remains under-analyzed. This gap benefits cash buyers who capitalize on the seller’s urgency, often without the seller fully understanding the time-value trade-off. By not measuring the true impact of transaction speed, sellers may underestimate the value of rapid liquidity, which is the core appeal of cash offers.

Scale Jump: Micro to Macro Housing Dynamics

Just as microorganisms adapt to environmental stress by altering their structures for survival, cash home-buyers adjust their strategies in response to market fluctuations. On a macro scale, these adaptive behaviors parallel cities’ responses to economic downturns, where real estate markets shift focus to liquid assets to maintain stability. This scale invariance highlights a universal principle: adaptability in resource allocation ensures survival across both biological and economic landscapes.

Non-Human Perspective: The View from a Financial Algorithm

From the perspective of a financial algorithm, human property transactions are merely data points in vast, complex models. Algorithms prioritize efficiency, speed, and predictability, much like the cash-buying process. Unlike human buyers, algorithms lack emotional attachment, viewing properties solely as investments. This perspective reveals the stark contrast between human emotional valuation and algorithmic assessment, suggesting that human sellers could benefit by adopting more data-driven approaches to property valuation.